In the past, trading was often thought to be the domain of only intellectually savvy and financially capable individuals. Over the last few years, however, this story has changed. With easier access to online trading, demo trading, and his online lessons, it’s easier to understand what forex trading is and what it’s like to actually trade. People realized that trading doesn’t have to be hard, and it’s not just for the rich and smart.

Transactions can be simple or complex. In any case, traders can profit from the forex market regardless of whether the trading strategy used is easy or difficult. Easy trading based on simple rules.

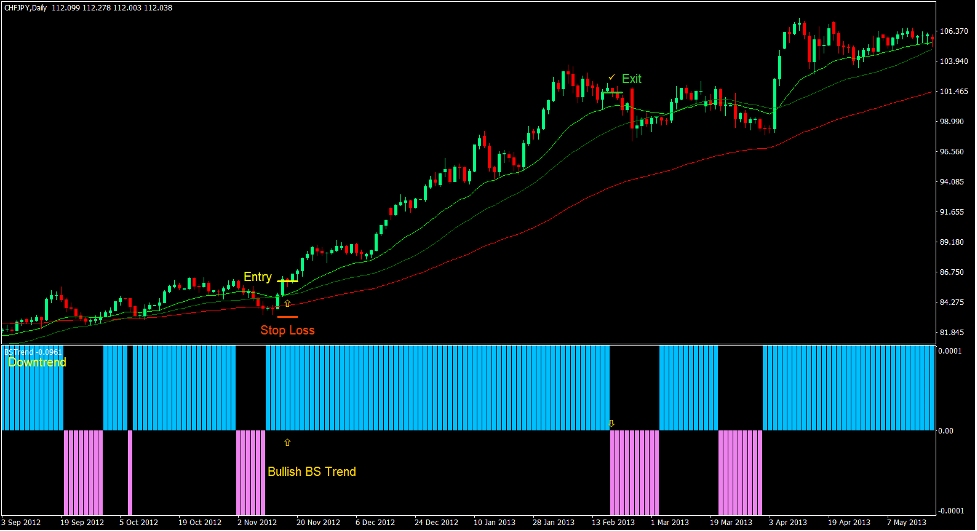

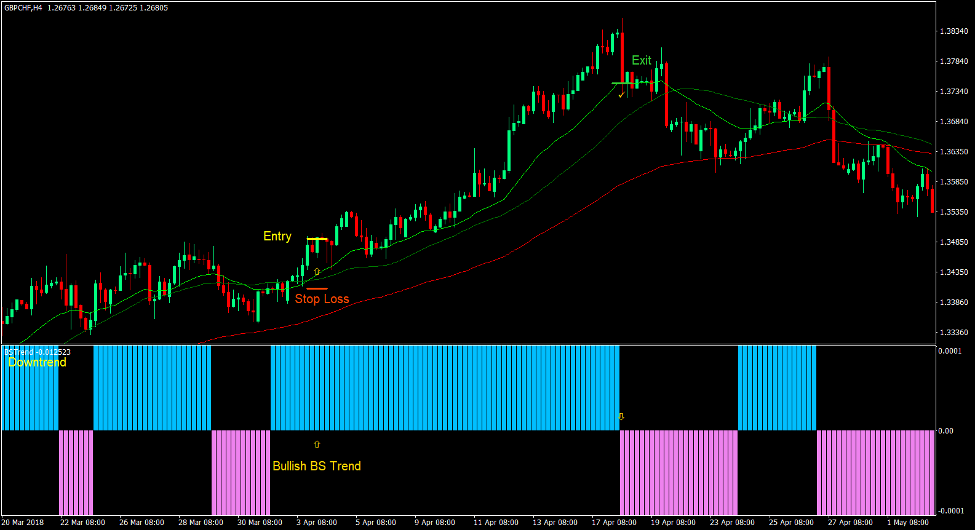

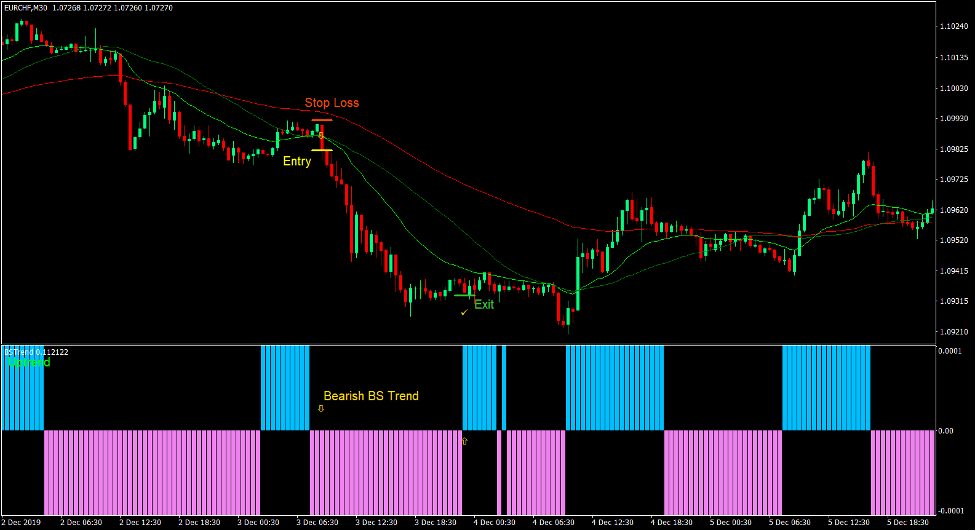

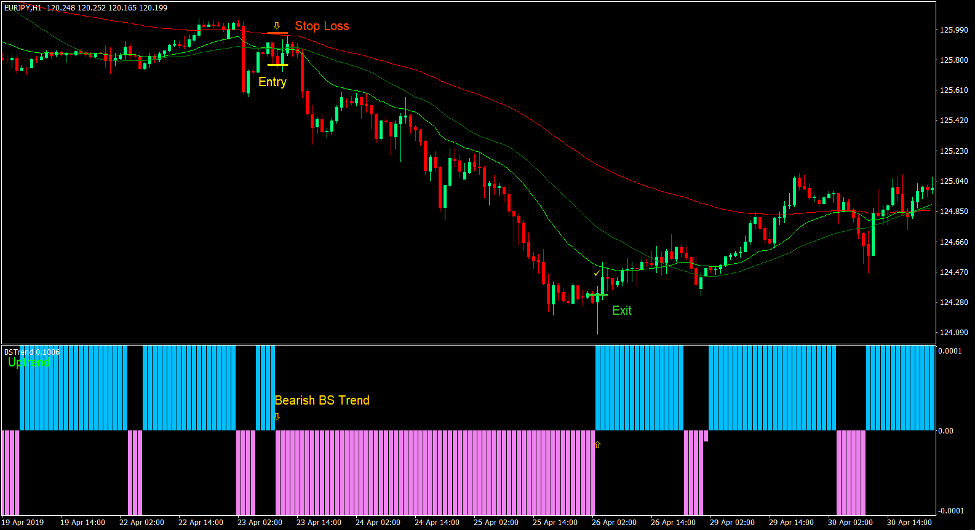

Trending markets are some of the easiest market conditions to trade. This is because the price often tends to move in the direction of the trend, greatly increasing your chances of winning.

Momentum is also another market scenario that offers a high probability trade that can also be a high yield trade. This is because momentum often causes price to continue in the direction of the most recent momentum shift.

MA ribbon 89.21

89.21 Filled with MA Ribbon is a custom trend following technical indicator based on moving averages.

One of the most common ways traders identify trend bias and trend direction is by using moving averages. Traders can identify trend direction based on the position of the price action relative to the moving averages and the slope of the moving averages.

Going a step further, traders use the intersection of two or more moving averages to identify trend reversals and trend directions. Traders often use this as a base to enter a trend reversal setup.

The MA Ribbon Filled 89.21 indicator is based on this concept. This is a pair of two modified moving averages that tend to be very effective in identifying trends.

BS trend

BS trend is essentially a binary custom momentum indicator.

This indicator only identifies the direction of the most recent momentum shift. Then plot the bar at -0.0001 or 0.0001. A negative bar indicates that the most recent momentum shift was bearish. On the other hand, a positive bar indicates that the recent momentum shift was bullish. The bar shifts whenever the momentum shifts in the opposite direction.

Given the nature of this technical indicator. Traders can initially use this indicator as a momentum filter. Traders can identify the direction of the latest momentum shift and only trade accordingly.

Can also be used as a trigger for momentum reversal entries. A trader can enter a momentum reversal trading setup using a bar shift from negative to positive or vice versa as a signal.

trading strategy

This trading strategy trades in the direction of the medium-term trend while utilizing the trend reversal signals of the underlying moving average of the MA Ribbon Filled 89.21 indicator and the momentum signals of the BS trend indicator.

The direction of the trend is mainly identified based on the position of the price action relative to the slow moving average of the MA Ribbon Filled 89.21 Indicator and the direction of its slope. This moving average is represented by the red line.

The BS trend indicator acts as a momentum filter and the first indication of a possible trend reversal after a momentum shift. Trades are made only in the direction indicated by the BS trend bar. Momentum shift signals should also be fresh as the trend is likely to continue.

Finally, the entry trigger is based on the intersection of the lime line, the fast moving average of the MA Ribbon Filled 89.21 indicator and the 36 period simple moving average.

index:

- 89.21 with MA ribbon

- 36 SMA (green)

- Bull Bear RSI

Preferred timeframe: 30 minute, 1 hour, 4 hour and daily charts

Currency pair: Forex Major, Minor, Cross

Trading session: Sessions in Tokyo, London and New York

Trading setup

entry

- Price action should be above the red line of the MA Ribbon Filled 89.21 indicator.

- The red line should point upwards.

- The BS trend bar should shift to positive.

- The lime line of the MA Ribbon Filled 89.21 indicator should cross the 36 SMA line (green).

- Please confirm these conditions before entering a buy order.

stop loss

- Place a stop loss on the support below the entry candle.

Exit

- Close the trade as soon as the BS trend bar shifts to negative.

sell trade settings

entry

- Price action should be below the red line of the MA Ribbon Filled 89.21 indicator.

- The red line should point downwards.

- The BS trend bar should be negatively shifted.

- The lime line of the MA Ribbon Filled 89.21 indicator should cross below the 36 SMA line (green).

- Please confirm these conditions before entering a sell order.

stop loss

- Place a stop loss at the resistance above the entry candle.

Exit

- Close the trade as soon as the BS trend bar shifts to positive.

Conclusion

A trend following strategy combined with a momentum signal is a very good trade setup.

A trend following strategy answers the question of which direction a trader should go. But answering this question is only half the battle. Traders should ask themselves when and where to trade.

Momentum signals answer the question of when to trade. This is because momentum signals are an accurate indicator of momentum shifts and can lead to new trends.

Besides, confirming moving average crossovers adds another confluence layer that helps increase the probability of trade setups.

Forex Trading Strategy Installation Instructions

BS Trend Momentum Forex Trading Strategy is a combination of Metatrader 4 (MT4) indicator and template.

The essence of this forex strategy is to convert accumulated historical data and trading signals.

BS Trend Momentum Forex Trading Strategy provides an opportunity to detect various peculiarities and patterns in price dynamics which are invisible to the naked eye.

Based on this information, traders can anticipate further price movements and adjust this strategy accordingly.