Whenever trading in the Forex market, there are two psychological factors that play into the trader’s mind. One is greed and the other is fear. Most traders blame greed for causing them to lose money while trading, but fear also damages a trader’s account.

Seasoned traders know that there are winners and losers when trading the market. Traders often lose money out of greed and often stray from their game plan. But disciplined traders lose money not because of greed, but purely because the market is the market and they do whatever they want. It’s all part of the stats of his or her strategy. However, traders may not be able to recover from losses that are part of the statistic because they are afraid to take trades that could be profitable. All this is due to fear.

One distinct opportunity traders often miss is when the market starts a trend. Many traders drool when they see a market trend and wish they could take a trade when the trend starts. However, they would rather not take the risk out of fear that the trend might end soon.

There are many possibilities in the trending market. Traders need to know how to enter trending markets without chasing prices.

Ichimoku Kinko Hyo

Ichimoku Kinko Hyo is one of the few technical indicators that can claim to be a complete trading system on its own. This is possible because the indicator gives traders a bird’s eye view of what the market is doing, from long-term trends to short-term trends to immediate price action.

The Ichimoku Kinko Hyo consists of several modified moving averages, mainly based on the median price over a period of time.

The conversion line or conversion line is calculated as the median price over the last 9 time periods. This line represents the short-term trend. This line is usually used along with the baseline line to confirm short-term trend reversals.

The baseline or baseline is based on the median price over the last 26 time periods. This line represents the short to medium term trend. This line can give an early warning of a possible trend reversal, so it can be used as a trailing stop loss point.

Leading Span A or Leading Span A is derived from the median value of the Tenkan and Baselines plotted 26 periods ahead.

Leading Span B or Leading Span B is the median price over the last 52 periods plotted 26 periods ahead.

Flash spans A and B form a cloud or clouds. Clouds represent the long-term trend direction. The long-term trend is bullish if the leading span A is above the leading span B. On the other hand, if the leading span A is below the leading span B, the long-term trend is bearish.

A lagging span or lagging span is the closing price of the current period plotted 26 periods ago. This line can be used to determine the price action characteristics. It can also be used to identify potential support or resistance levels based on swing points.

FBS Fisher

FBS Fisher is an oscillator-type technical indicator based on the Gaussian normal distribution concept. This indicator derives its calculations from the past movements of the price movement and transforms the numbers into a Gaussian normal distribution. This normalizes price movements within the oscillator range and helps traders identify potentially oversold or overbought markets.

The resulting numbers are plotted as positive or negative histogram bars. This indicator changes the color of the bars to show the potential for gaining or weakening momentum.

A positive gold bar indicates a strengthening bullish trend and a negative gold bar indicates a strengthening bearish trend. A positive red bar indicates a weakening bullish trend and a negative lime bar indicates a weakening bearish trend.

trading strategy

The Ichimoku Fisher Forex Trading Strategy can be used as a long-term trend following or trend re-entry strategy.

Kumo is used to identify the long-term trend direction based on how the leading spans A and B overlap and the color with which the areas within Kumo are shaded.

Retraction temporarily reverses the conversion line and reference line. Also, the FBS Fisher bar should flip temporarily.

The market is considered to be continuing the trend direction when the Tenkan Line crosses the Kijun Line towards the direction of the trend and FBS Fisher crosses the midline and plots a gold bar indicating the direction of the trend. This constitutes a valid trading setup.

index:

- Ichimoku Kinko Hyo

- FBS Fisher

Preferred timeframe: 1 hour and 4 hour charts

Currency pair: Forex Major, Minor, Cross

Trading session: Sessions in Tokyo, London and New York

Trading setup

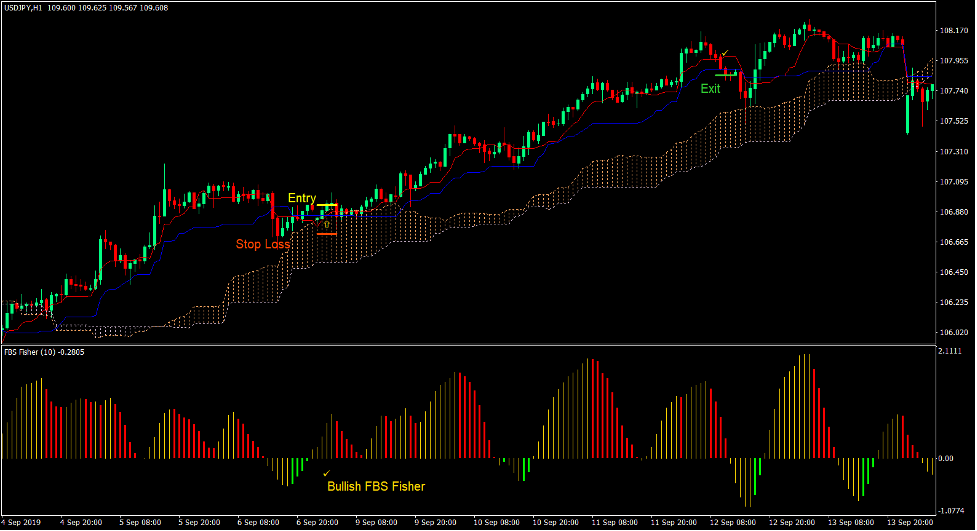

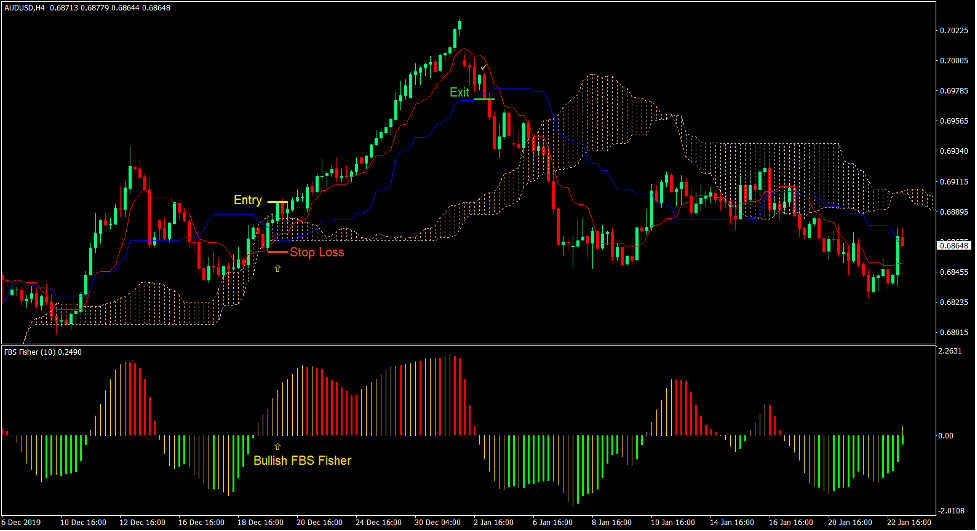

entry

- Leading span A should be above leading span B and the clouds should be sand brown.

- Price action should be in an upward trend.

- The price pulls back towards the clouds, the Celestial Line dips briefly below the Kijun Line, and the FBS Fisher bars turn negative.

- Enter a buy order as soon as FBS Fisher plots a positive gold bar and the celestial line crosses above the baseline.

stop loss

- Place a stop loss on the support below the entry candle.

Exit

- Close the trade as soon as the price breaks below the reference line.

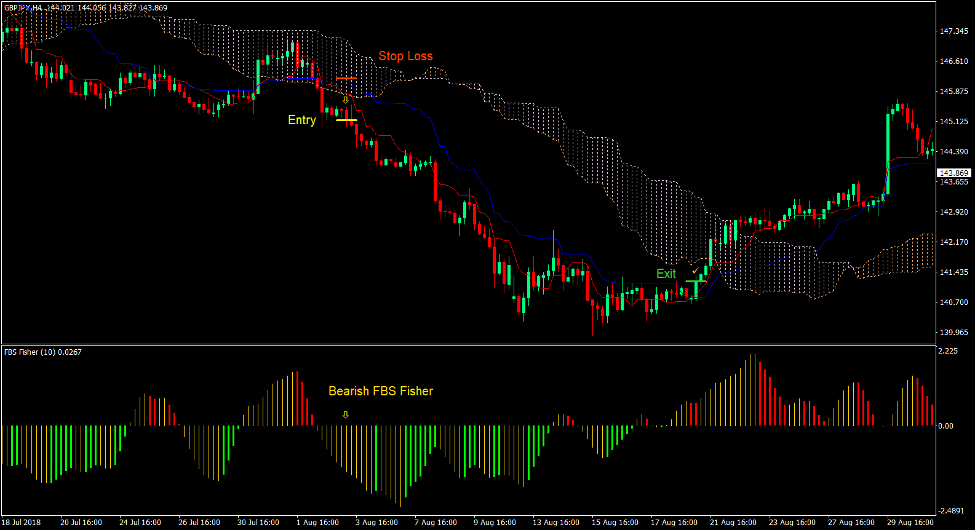

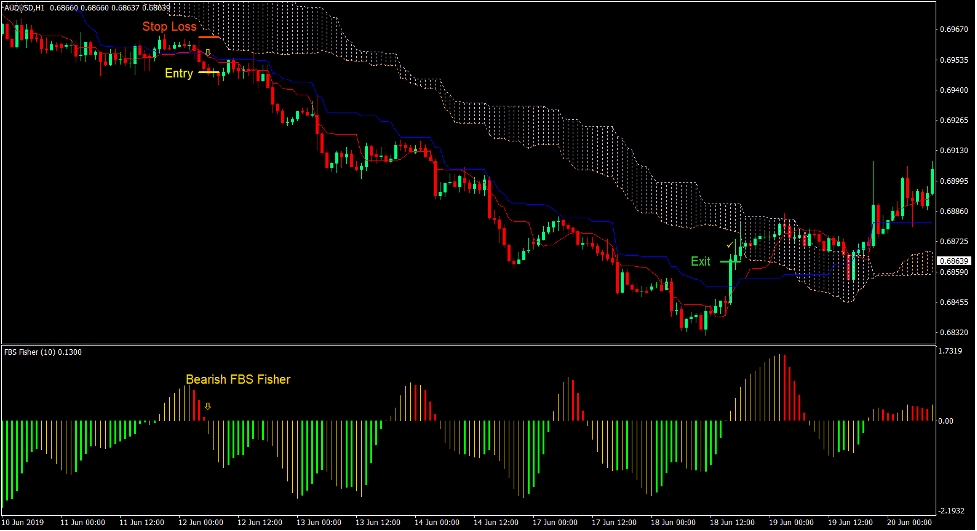

sell trade settings

entry

- Lead span A must be below lead span B and the clouds must be thistles.

- Price action should be in a downward trend.

- The price pulls back towards the clouds, the celestial line briefly rises above the reference line, and the FBS Fisher bars turn positive.

- Enter a sell order as soon as the FBS Fisher plots the negative gold bars and the celestial line falls below the baseline.

stop loss

- Place a stop loss at the resistance above the entry candle.

Exit

- Close the trade as soon as the price closes above the reference line.

Conclusion

The Ichimoku Kinko Hyo indicator is an indicator that can be a complete trading system on its own. In fact, crossing over tenkansen and kiseisen while collaborating with clouds is considered a common Ichimoku Kinko Hyo strategy.

FBS Fisher serves as an additional confirmation layer that traders can use to improve their winning odds. However, the trader can also use his FBS Fisher his bars shift as his trigger for entry. This is a more aggressive method, but it can also mean an early entry that allows traders to squeeze out a bit more profit.

Forex Trading Strategy Installation Instructions

The Ichimoku Fisher Forex Trading Strategy is a combination of MetaTrader 4 (MT4) Indicators and Templates.

The essence of this forex strategy is to convert accumulated historical data and trading signals.

Ichimoku Fisher Forex Trading Strategy provides an opportunity to detect various peculiarities and patterns in price dynamics which are invisible to the naked eye.

Based on this information, traders can anticipate further price movements and adjust this strategy accordingly.