Many traders aim to trade at the beginning of a new trend and close at or near the end of the same trend. One of the types of trading strategies that allow such kind of trading results is the trend reversal trading strategy.

A trend reversal strategy is a type of trading strategy in which at the end of a trend the trader expects a new trend in the opposite direction of the previous trend. Traders aim to enter a trade near the beginning of the trend and exit near the end of the trend.

Given the nature of trend reversal strategies, such types of strategies naturally end up producing trade setups with high profit potential. However, it tends to be less accurate compared to trend continuation strategies as traders trade against the flow of the market. One of the keys to trading trend reversal strategies is finding ways to improve accuracy while maintaining the high potential rewards that trend reversal strategies offer.

There are various methods of trend reversal. One of the most popular ways is to use moving average crossovers as a trend reversal indicator. Traders who are able to maintain high average yields while finding crossover settings with improved accuracy can consistently profit from the forex market.

This strategy looks at crossovers between two modified moving averages and confluences of trend confirmation from popular oscillators.

megatrend

The Megatrend indicator is a custom trend following technical indicator based on moving averages. In fact, megatrend lines are basically modified moving averages.

The Mega Trend Line plots a moving average line aligned with the long-term trend. Most moving averages are prone to false signals in volatile market conditions, while megatrend lines tend to be stable compared to most moving averages. This is because the characteristics of this line are very smooth and less prone to false signals.

The Mega Trend Line changes color whenever a trend reversal is detected. A blue line is plotted for a bullish trend and a red line for a bearish trend. Traders can use the color change as an indicator of a trend reversal.

MUV indicator

The MUV indicator is another custom trend following technical indicator that is also based on Modified Moving Averages.

This indicator basically plots its own moving average line that is very sensitive to changes in price movements. It is very closely aligned with the price movement, which means the line is moving closely with the price movement. This property makes the MUV line an excellent indicator of short-term trends or momentum.

The MUV line can be used together with another moving average line to create a crossover trend reversal signal.

relative strength index

The Relative Strength Index (RSI) is a popular oscillator-type technical indicator that can be used in a variety of market conditions.

This oscillator plots a line that varies between 0 and 100. Traders can identify trend bias based on where the RSI line is relative to the median (50). The trend is bullish when the RSI line is generally above it. It is bearish when the RSI line is generally below it.

The RSI also has level 30 and 70 markers. An RSI line below 30 indicates an oversold market and an RSI line above 70 indicates an overbought market. Both market conditions are in a period of mean reversal.

However, momentum traders may also see a drop below 30 as a sign of bearish momentum and above 70 as a sign of bullish momentum. Everything comes down to the characteristics of price action when the RSI line hits these levels.

Many trend following traders also add levels 45 and 55 to confirm trends. In a bull trend level 45 acts as a support level and in a bear trend level 55 acts as a resistance level for the RSI line. A level above 55 can be used to confirm a bullish trend reversal and a level below 45 can be used to confirm a bearish trend reversal.

trading strategy

The Mega Trend MUV Cross Forex Trading Strategy is a trend reversal strategy that utilizes the above indicators to confirm moving average crossover settings.

This setting uses the Megatrend line as the long-term moving average and the MUV line as the short-term moving average. A signal is considered whenever two lines cross.

However, the color of the mega trend line should confirm a potential trend reversal. The crossover should also closely match the color change of the megatrend line.

The RSI is then used as confirmation of a trend reversal. This is based on the RSI line above 55 on a bullish trend reversal or below 45 on a bearish trend reversal.

index:

- megatrend

- MUVs

- relative strength index

Preferred timeframe: 30 minute, 1 hour, 4 hour and daily charts

Currency pair: Forex Major, Minor, Cross

Trading session: Tokyo, London, New York sessions

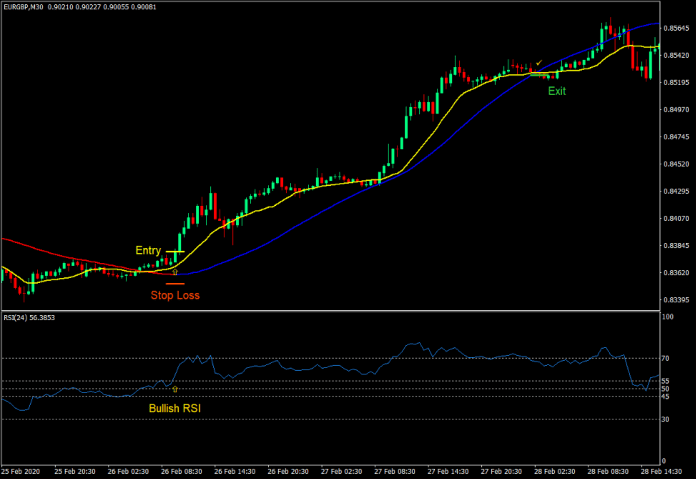

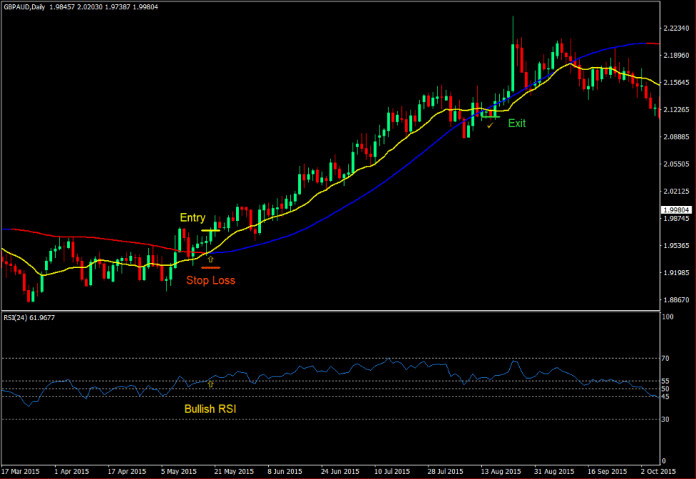

Purchase transaction settings

entry

- The Mega Trend Line should turn blue.

- The MUV line should cross above the megatrend line.

- The RSI line should be above 55.

- Enter a buy order at the confluence of these conditions.

stop loss

- Place a stop loss on the support below the entry candle.

Exit

- Close the trade as soon as the MUV line breaks below the megatrend line.

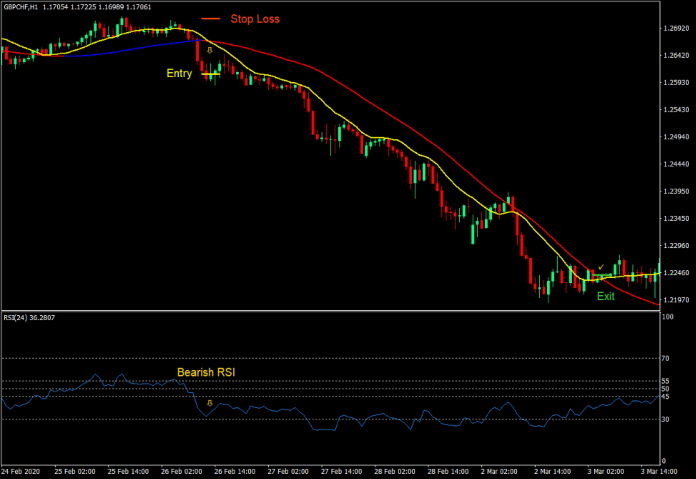

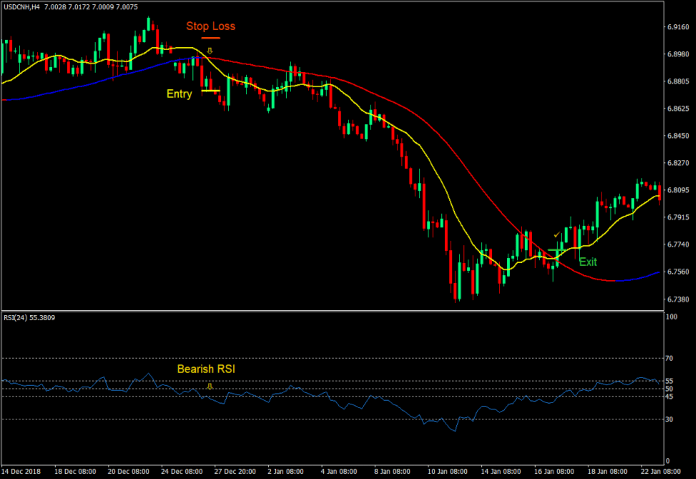

Sell trade setup

entry

- The Mega Trend Line should turn red.

- The MUV line should fall below the megatrend line.

- The RSI line should be below 45.

- Enter a sell order when these conditions meet.

stop loss

- Set your stop loss to the resistance value above the entry candle.

Exit

- Close the trade as soon as the MUV line breaks out of the megatrend line.

Conclusion

This trading strategy is a good moving average based crossover strategy as it tends to produce relatively high winning trade setups compared to most moving average crossover setups.

Many crossover signals come from two moving averages. However, not all converge between megatrend line color change and RSI trend confirmation. Traders who can identify trend reversal setups at such confluences can use this strategy to trade trend reversal setups.

Forex Trading Strategy Installation Instructions

Mega Trend MUV Cross Forex Trading Strategy is a combination of Metatrader 4 (MT4) Indicator and Template.

The essence of this forex strategy is to convert accumulated historical data and trading signals.

Mega Trend MUV Cross Forex Trading Strategy provides an opportunity to detect various peculiarities and patterns in price dynamics which are invisible to the naked eye.

Based on this information, traders can anticipate further price movements and adjust this strategy accordingly.