What often distinguishes a good trader from a great trader is that a good trader knows how to pick his battles. I know there is a trading opportunity. But they also know that not all market conditions are likely to yield good profits. Good traders, on the other hand, choose to trade only on market conditions where they are most likely to make a profit.

Trending markets are one of the most favored types of market conditions that good traders want to trade. This is because in trending market conditions, price is more likely to move in the direction of the trend than against it. This eliminates the question of which direction to trade and greatly increases your chances of winning a trade. The next question is where do they do their trades? Most traders place trades in the direction of a trend whenever they see a trend. On the other hand, good trends that follow traders would rather wait for a pullback. This allows them to enter the market at a better price. and have a positive risk-reward ratio. The combination of high probability trade setups and a decent risk reward ratio allows you to consistently profit from the forex market.

slope direction line

The Slope Line is a custom trend following technical indicator based on moving averages.

In fact, the Slope Direction Line itself is actually a modified moving average. Most moving averages are highly susceptible to false trading signals, which often occur during choppy market conditions. Traders are often tricked by the market into taking trades at the peak of a bullish outlook or at the bottom of a bearish outlook. It tends to manage these situations very well, as it tends to show reversal only when reversing to . .

Gradient Direction Line plots a line that changes color depending on the direction of the gradient. The light blue line indicates a bullish trend bias and the tomato line indicates a bearish trend bias.

AVQ trends

The AVQ trend indicator is a custom momentum indicator that helps traders identify the direction of short-term trends or momentum.

This indicator overlays price candle bars that change color depending on the direction of momentum. In this setting, blue bars indicate bullish momentum and red bars indicate bearish momentum.

Given the nature of the AVQ trend indicator, this indicator can be used as a short-term trend reversal entry signal. Traders can easily place trades in the direction of the trend as the bar changes color.

trading strategy

The AVQ trend direction forex trading strategy is a trend following trading strategy that trades on retracements using a combination of a 100 period Exponential Moving Average (EMA), an AVQ trend indicator and a slope direction line indicator.

Trades are first filtered based on the long-term trend direction. A long-term trend is identified based on the price action relative to the 100 EMA line and the position of the slope direction line and the slope of the 100 EMA line.

The medium-term trend direction is identified based on the slope and color of the slope direction line. The direction of the slope line should match the direction of the long-term trend.

Then wait for the price action to move back towards the area of the slope direction line. This will temporarily change the color of the AVQ trend bars. Trades are taken as soon as the AVQ trend bars resume their color in the direction of the long-term trend.

index:

- AVQ_trend

- (T_S_R) – Slope direction line

- 100EMA

Preferred timeframe: 30 minute, 1 hour, 4 hour and daily charts

Currency pair: Forex Major, Minor, Cross

Trading session: Sessions in Tokyo, London and New York

Trading setup

entry

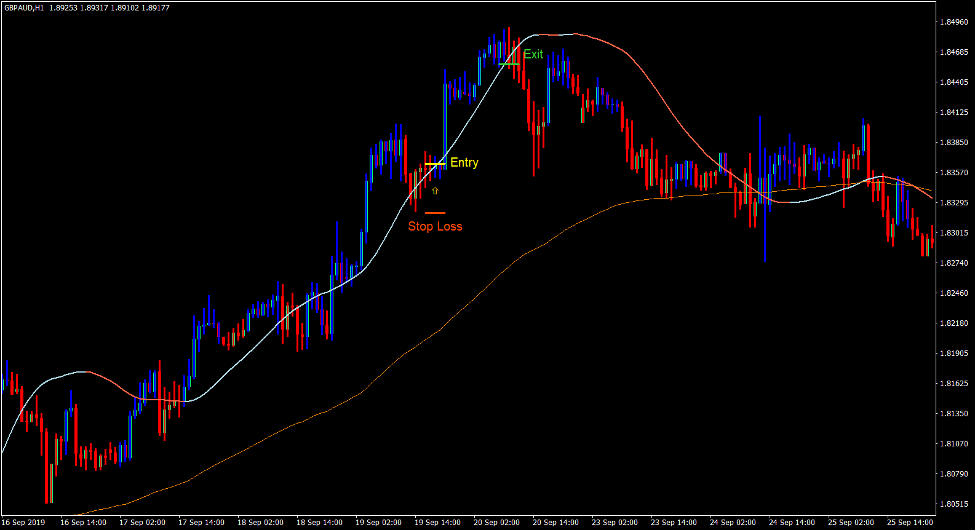

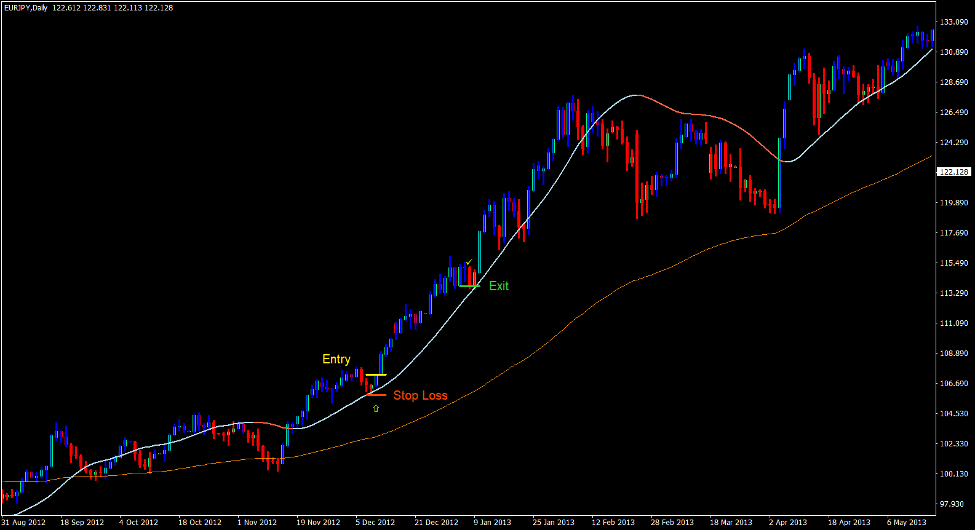

- Price action should be above the 100 EMA line.

- The slope direction line must cross over the 100 EMA line.

- The slope direction line should be light blue.

- Price action is pulled back towards the slope direction line and the AVQ trend bar briefly turns red.

- Enter a buy order as soon as the AVQ trend bar turns blue.

stop loss

- Place a stop loss on the support below the entry candle.

Exit

- Close the trade as soon as the AVQ trend bar turns red.

sell trade settings

entry

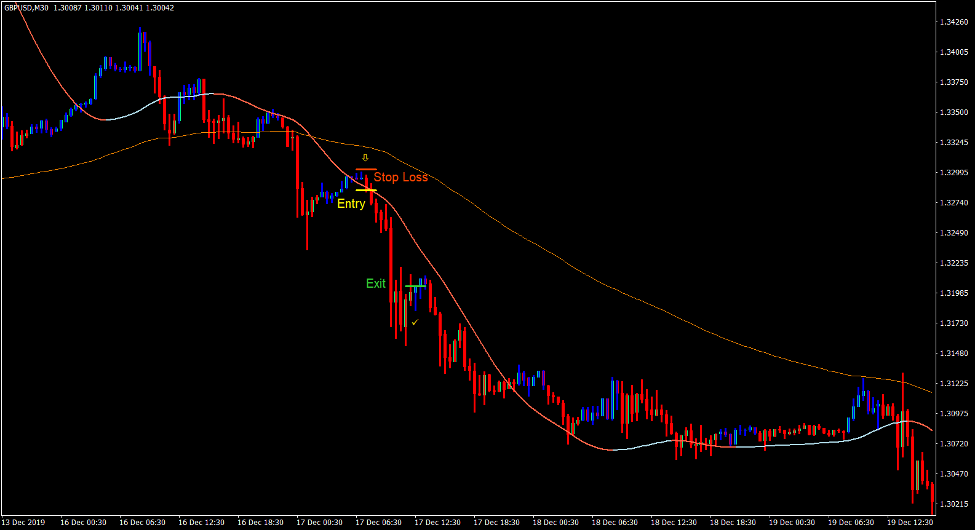

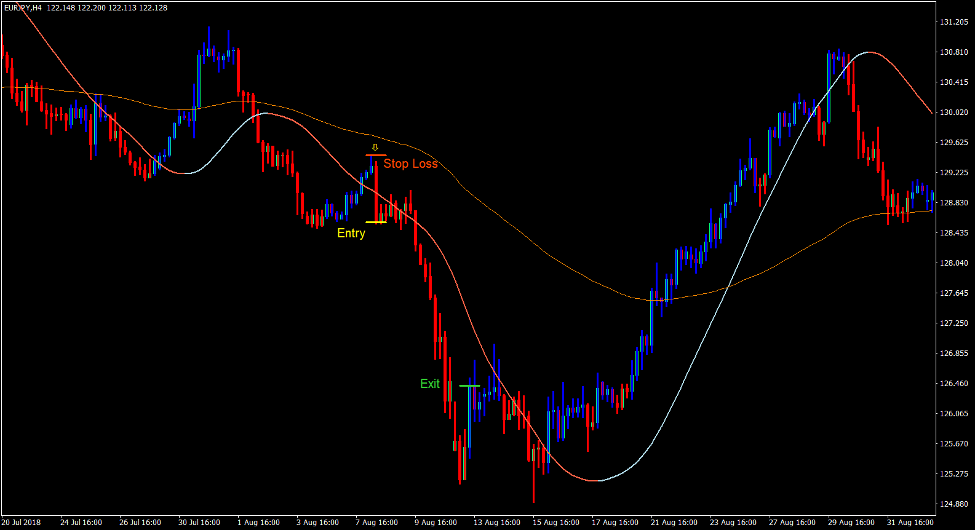

- Price action should be below the 100 EMA line.

- The slope direction lines should cross below the 100 EMA line.

- Gradient direction lines must be tomatoes.

- Price action is pulled back towards the slope direction line and the AVQ trend bar briefly turns blue.

- Enter a sell order as soon as the AVQ trend bar turns red.

stop loss

- Place a stop loss at the resistance above the entry candle.

Exit

- Close the trade as soon as the AVQ trend bar turns blue.

Conclusion

This trading strategy is a simple trend following strategy that allows traders to set trades with decent win rates and risk reward ratios.

Aligning long-term trends with medium-term trends creates trade setups that are likely to move in one direction.

Pullback trading based on systematic trading signals allows traders to avoid guessing themselves when trading in the forex market.

This trading strategy can potentially produce good returns when used on trending forex pairs.

Forex Trading Strategy Installation Instructions

AVQ Trend Direction Forex Trading Strategy is a combination of Metatrader 4 (MT4) indicator and template.

The essence of this forex strategy is to convert accumulated historical data and trading signals.

AVQ Trend Direction Forex Trading Strategy provides an opportunity to detect various peculiarities and patterns in price dynamics which are invisible to the naked eye.

Based on this information, traders can anticipate further price movements and adjust this strategy accordingly.